Before you begin

- This article reviews Ascend Pay and QuickBooks integration. Haven't heard of Ascend Pay? Click here to join the fun!

- This is only required if you integrate Ascend with QuickBooks.

QuickBooks

- In QuickBooks, create a new clearing account (other current asset, OCASSET) to be used for the Ascend Pay In Transit funds.

- The OCAsset account is a new account that needs to be created by all Ascend Pay customers.

- Note: If you are a multi-store retailer, it is recommended to create a OCASSET account for each location.

- The OCAsset account is a new account that needs to be created by all Ascend Pay customers.

- Import the new Chart of Accounts from QuickBooks into Ascend by following these instructions.

Ascend Options

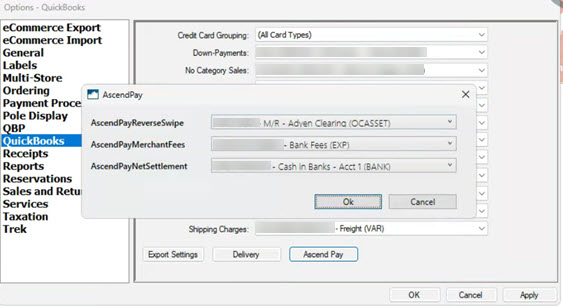

- Navigate to Options > QuickBooks.

- Change Credit Card Grouping to (All Card Types).

- Click the Ascend Pay button.

- Map the following accounts:

- AscendPayReverseSwipe: Enter in the newly created clearing account mentioned in the QuickBooks section above. This will temporarily hold funds not yet deposited into your bank account.

- AscendPayMerchantFees: Enter in the expense account for credit card fees.

- AscendPayNetSettlement: Enter in the bank account Ascend Pay will be using to deposit the funds captured.

- Click OK to save changes.

Ascend Database Explorer

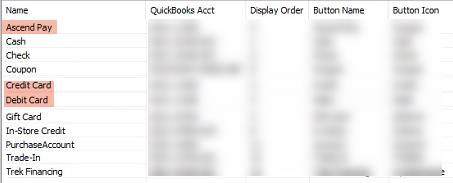

- Navigate to Database Explorer > Payment Types.

-

For the following Payment Types, change the QuickBooks Acct mappings to the newly created clearing account from the QuickBooks Setup section above.

- Ascend Pay

- Credit Card

- Debit Card

KB24-008